What Does Fortitude Financial Group Mean?

What Does Fortitude Financial Group Mean?

Blog Article

Some Known Facts About Fortitude Financial Group.

Table of ContentsThe Definitive Guide for Fortitude Financial GroupIndicators on Fortitude Financial Group You Need To KnowFortitude Financial Group for DummiesThe smart Trick of Fortitude Financial Group That Nobody is DiscussingNot known Details About Fortitude Financial Group

Note that several experts will not handle your assets unless you meet their minimal requirements (St. Petersburg Investment Tax Planning Service). This number can be as low as $25,000, or reach right into the millions for the most unique advisors. When picking a financial consultant, discover if the individual follows the fiduciary or suitability standard. As noted previously, the SEC holds all experts signed up with the company to a fiduciary standard.The broad area of robos spans systems with accessibility to financial experts and investment monitoring. If you're comfy with an all-digital platform, Wealthfront is one more robo-advisor option.

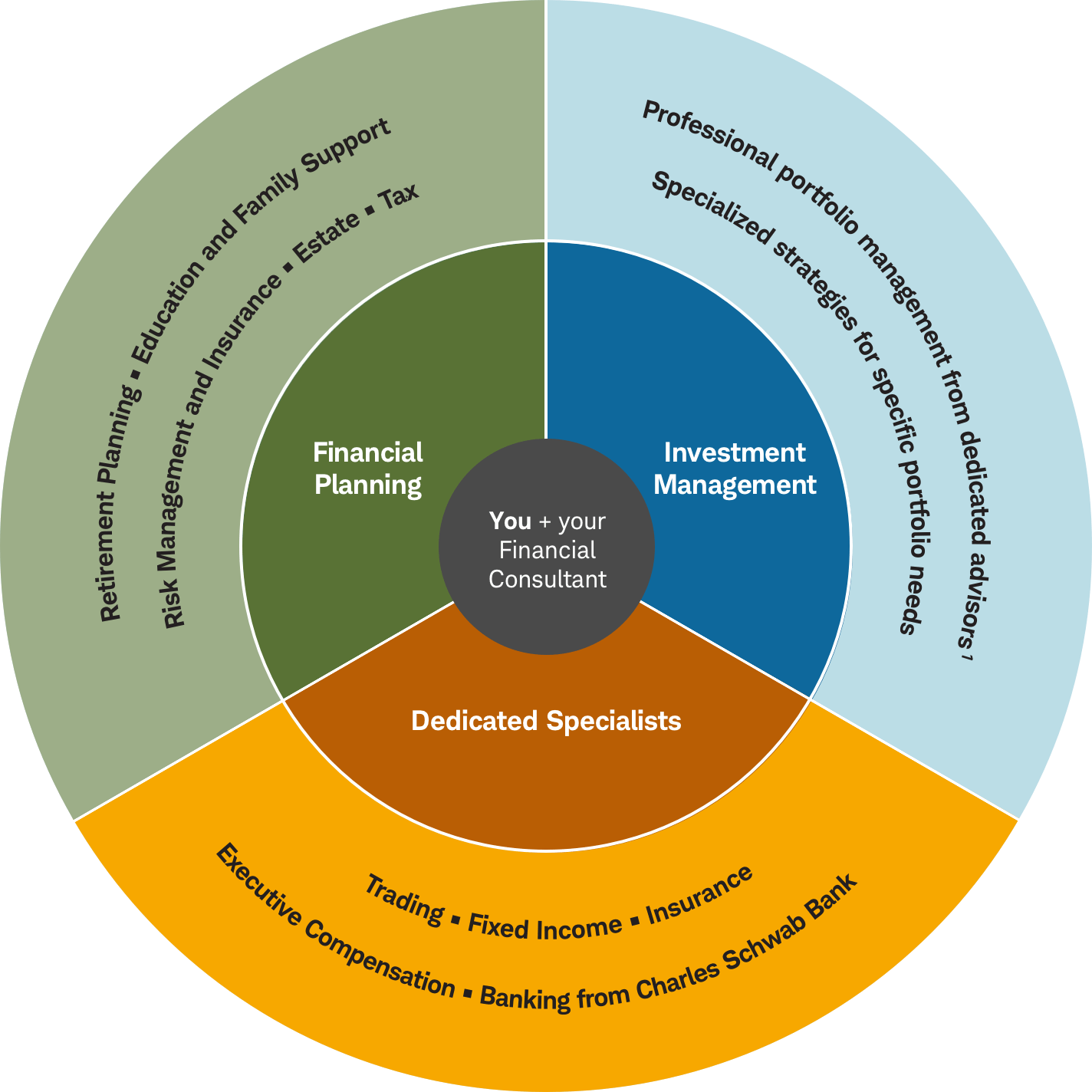

You can locate an economic expert to aid with any type of facet of your economic life. Financial experts might run their very own company or they could be component of a bigger workplace or bank. No matter, an expert can aid you with whatever from constructing a monetary strategy to investing your cash.

Fascination About Fortitude Financial Group

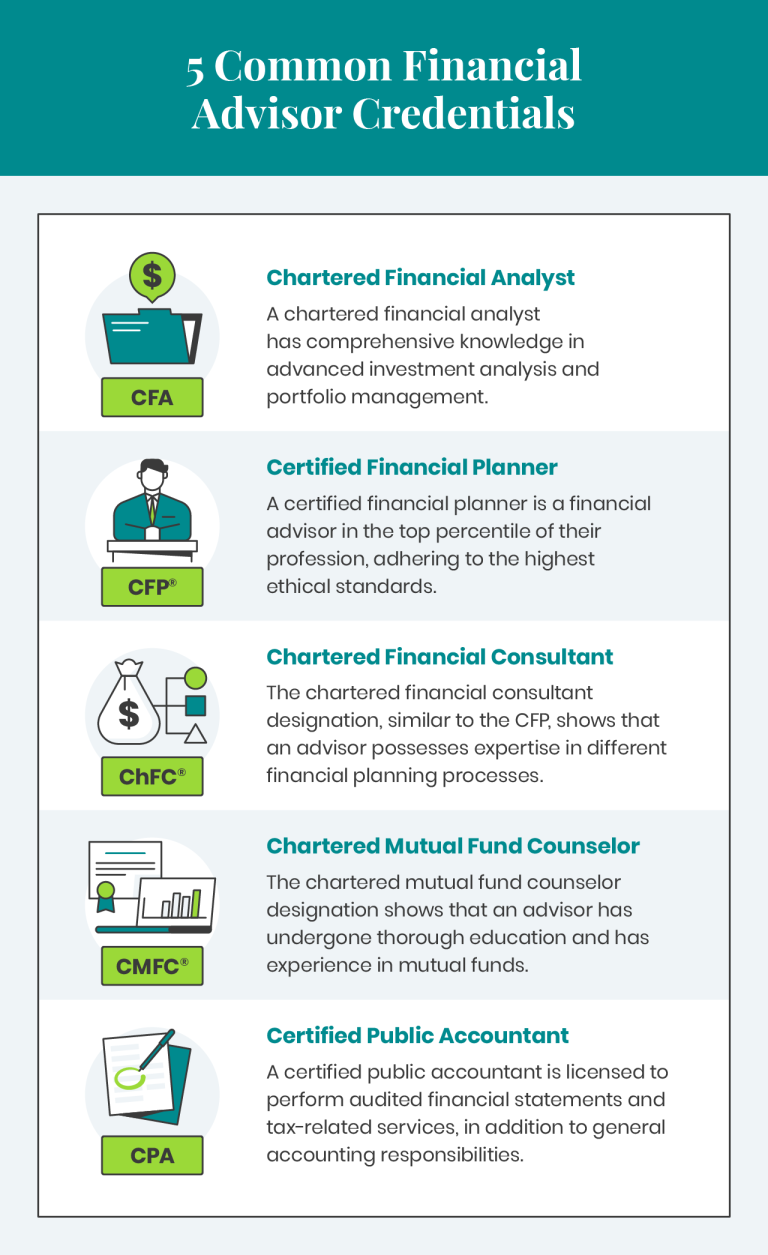

Consider functioning with a financial consultant as you develop or modify your economic plan. Locating a monetary advisor doesn't need to be tough. SmartAsset's cost-free device suits you with as much as 3 vetted financial consultants who serve your area, and you can have a complimentary initial telephone call with your consultant matches to decide which one you feel is right for you. Inspect that their credentials and skills match the services you desire out of your advisor. Do you want to learn even more about economic experts?, that covers concepts surrounding precision, credibility, editorial independence, experience and objectivity.

The majority of people have some emotional connection to their cash or things they get with it. This psychological connection can be a main reason that we might make inadequate monetary decisions. An expert economic expert takes the emotion out of the formula by providing unbiased recommendations based on expertise and training.

As you go with life, there are economic decisions you will make that could be made a lot more conveniently with the advice of a specialist. Whether you are attempting to reduce your debt lots or wish to start planning for some lasting objectives, you might take advantage of the services of a financial consultant.

Some Known Details About Fortitude Financial Group

The basics of financial investment management consist of purchasing and selling economic possessions and other financial investments, however it is more. Handling your financial investments entails recognizing your short- and lasting goals and using that details to make thoughtful investing decisions. An economic advisor can supply the information necessary to aid you diversify your investment portfolio to match your preferred level of threat and meet your monetary objectives.

Budgeting gives you a guide to just how much money you can invest and exactly how much you must save every month. Following a spending plan will help you reach your short- and long-lasting economic goals. A monetary expert can assist you describe the activity steps to require to establish and preserve a spending plan that functions for you.

Sometimes a clinical bill or home repair work can all of a sudden add to your debt lots. A specialist financial debt monitoring plan helps you repay that financial obligation in the most financially useful method possible. A financial consultant can aid you evaluate your financial debt, prioritize a financial debt settlement approach, provide options for financial obligation restructuring, and detail an alternative strategy to much better handle debt and fulfill your future economic goals.

Some Known Details About Fortitude Financial Group

Individual cash flow evaluation can inform you when you can manage to acquire a brand-new auto or just how much cash weblink you can contribute to your financial savings each month without running brief for necessary costs (Financial Advisor in St. Petersburg). A financial consultant can assist you clearly see where you invest your cash and afterwards use that insight to aid you understand your financial well-being and how to boost it

Danger management solutions recognize possible risks to your home, your car, and your family members, and they aid you put the best insurance plans in place to minimize those risks. A monetary advisor can assist you create a technique to protect your earning power and reduce losses when unexpected points take place.

Some Known Details About Fortitude Financial Group

Lowering your tax obligations leaves more cash to add to your financial investments. St. Petersburg Investment Tax Planning Service. A financial expert can assist you utilize philanthropic providing and financial investment approaches to lessen the amount you have to pay in tax obligations, and they can show you exactly how to withdraw your cash in retirement in a manner that also decreases your tax concern

Also if you really did not begin early, university planning can assist you put your kid with college without dealing with all of a sudden large expenditures. An economic advisor can guide you in recognizing the best ways to save for future university costs and just how to fund prospective voids, discuss how to minimize out-of-pocket college costs, and advise you on qualification for financial assistance and gives.

Report this page